In this blog we talk about how to do a Roth 401K conversion. This assumes that you already know what Roth is but need actual guidance on the execution.

We are a group of professionals who have backgrounds in both Big Tech (e.g. FAANG) companies and high-growth startups. We do dogfooding on our own financial advice and want to share this with you too. That's why we are building Vobil.com, an InsurTech company (we'll talk about insurance later in this blog series).

Before you begin, be sure to subscribe to Vobil's exclusive 📅 Personal Finance Calendar!

Step-by-step guide on 401K Roth conversation on three popular platforms: Vanguard, Fidelity, and Principal.

Why you need to do it before 2026

… But don't do it in one go:

How to minimize your tax consequences by stretching out over 2-4 years

Unless you live in a high tax state and plan to move. Period.

Almost everybody tells you to weigh it out on whether to do Roth conversion:

If you expect to have a higher tax rate during retirement, then you should do it when you are younger.

If you expect to have a lower tax rate, then wait and don't do Roth conversion.

But nobody knows for sure about their tax rate during retirement. I like to think from the psychological point of view: I'd rather have a peace of mind and not to worry about my tax consequences when I retire. Just Get It Done, TOO-DAY.

Because when you convert to Roth, you'll owe both federal and state taxes, thus you need to consider: if I'll move from a high tax state to low tax state in the near future, then I can hold off until after I move. Otherwise, go ahead and convert it.

For instance, if you currently live in California, but plan to relate to Washington or Texas this or next year, wait until you move.

However, in the other way around, if you live in Washington or Texas, but plan to move to other states that have state taxes, do it now before you move.

Enough said, let's move on to the why's. Because it first has to make sense to you, before you put your actions to it.

Because you'll pay less taxes due to the fact that your 401K might be just like 2022's SP500, which went down by roughly 15% as of writing.

The premise is that whenever you convert to Roth, you owe federal and state income taxes. Thus you want to minimize your tax liability in two ways:

Suppose your 401K started at $100K at the beginning of the year, and your 401K performance mirrors the market. There are two scenarios:

If the market goes up by 20%, then your 401K becomes $120K:

after a full conversion, you'll pay the tax on the entire $120K

the entire $120K will increase your taxable income, and will likely bump your tax bracket to the next level (such as from 24% to 32%)

If the market goes down by 20%, then your 401K becomes $80K:

after a full conversion, you'll pay the tax on the entire $80K

compared to Scenario A, you'll pay significantly less taxes

even better: because you converted to Roth at market low, you are well positioned for a market rebound and when it happens, all your gains are tax-free because of Roth! Once you fully understand the above scenario analysis, congratulations, now you are a master mind of the main considerations for a Roth conversion.

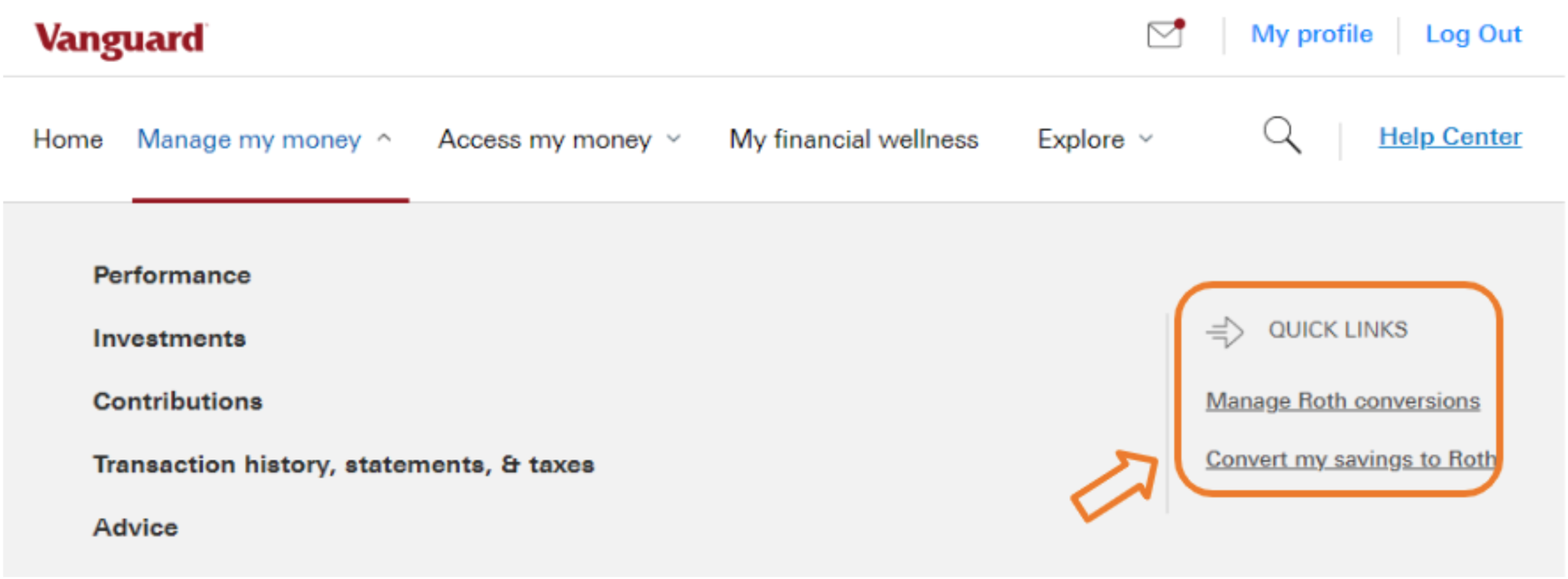

You can perform a Roth in-plan conversion online by logging in to your account at https://ownyourfuture.vanguard.com/main/dashboard and clicking “Manage my money”.

Then under “Manage my money”, there are quick links to convert to Roth:

Vanguard - Manage my money

If it doesn't show a conversion button: call Vanguard and ask a real person to read your plan terms to tell you whether your plan allows it.

From here on I'll use my own 401K as an example. A few years ago I left my previous job, which offered a 401K plan with Vanguard. My 401K plan stayed with Vanguard and it allows me to convert the pre-tax portion to Roth.

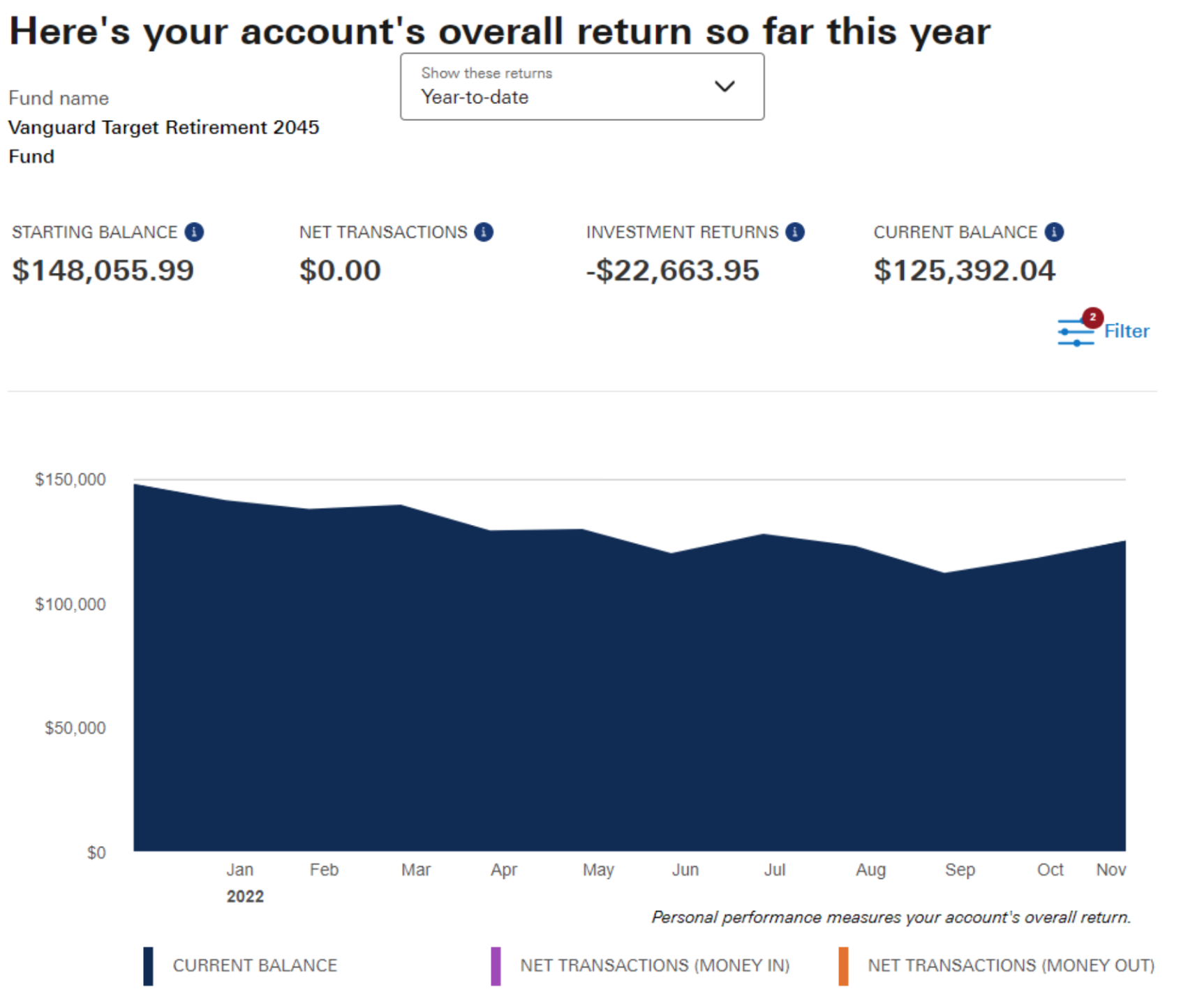

My 401K account is 100% invested in the Vanguard Target Retirement 2045 Fund (89% Stock and 11% Bond). Unfortunately, it has lost 15% by December 2022:

My Vanguard retirement plan went down 15% YTD by December 2022.

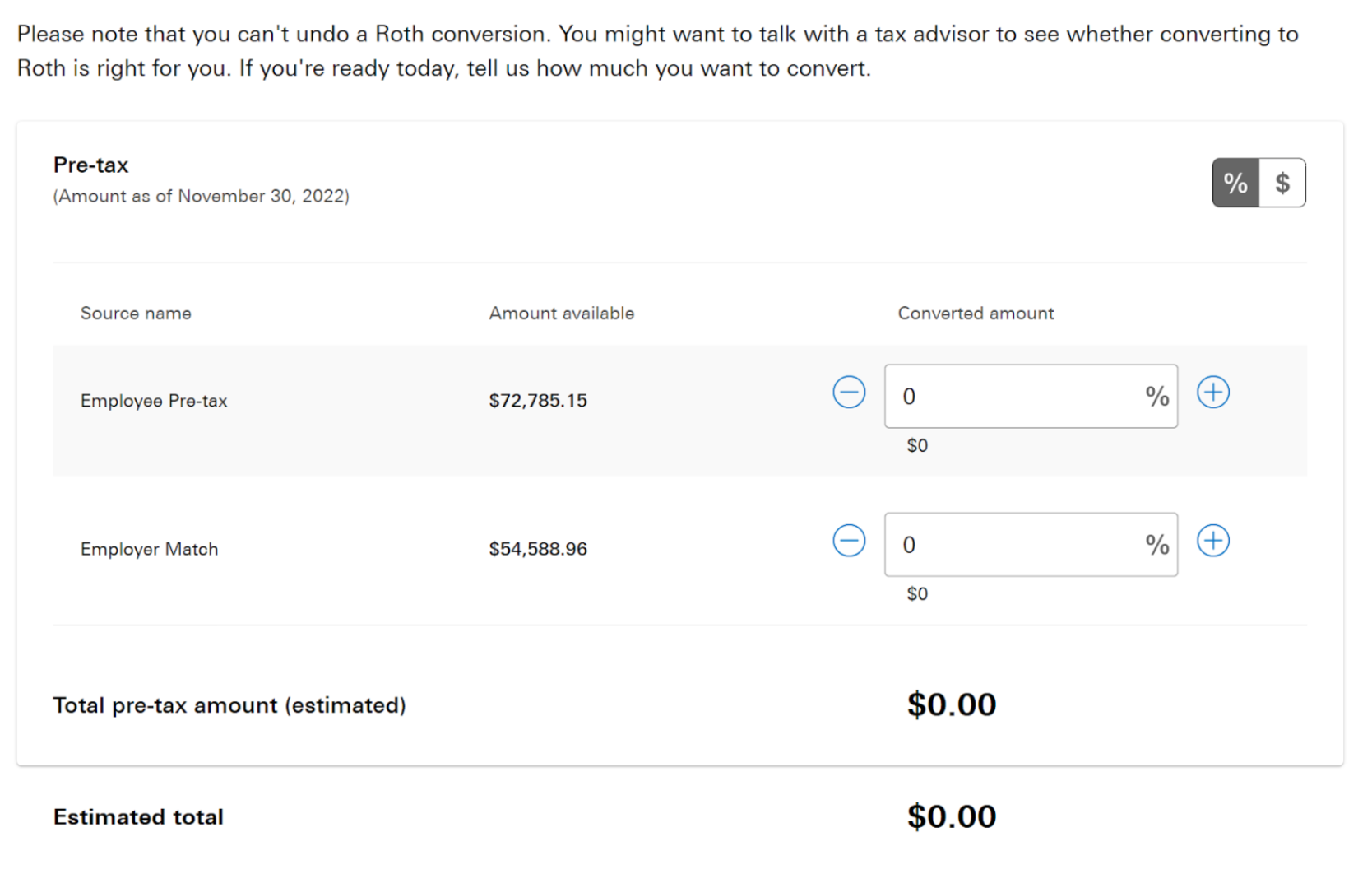

After clicking “Convert my savings to Roth”, Vanguard lets you choose what $ or % you want to convert:

Vanguard In-plan Roth Conversion for 401K

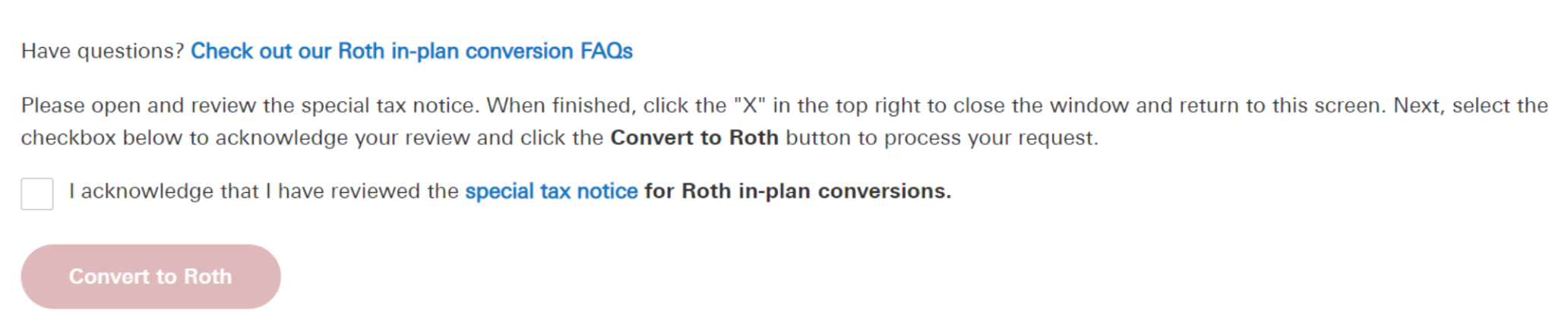

Vanguard makes it so easy that converting to Roth is just one click away:

Make sure to read through both FAQs and special tax notices before conversion to Roth

Hold your horses here before you click “Convert to Roth”: don't yet do a full 100% conversion. The tax owed on a conversion could be significant. We need to consider the consequences of potentially raising your tax brackets. Please finish reading this blog before you take any actions.

A lot of Big Tech companies offer their retirement plans to employees on Fidelity, such as Microsoft, Meta, and Amazon. However, Fidelity does not allow you to do an online conversion. You have to call Fidelity to figure out:

Microsoft people: I already called Fidelity for you – good news, your 401K plan allows you to do a Roth in-plan conversion. You can convert the pre-tax portion of your 401K plan into Roth in your 401K plan. Usually if the conversion is done by market close, it'll be converted the next day.

Fidelity has different phone numbers for their customer service. The number I dialed was 800-557-1900 (“workplace planning and advice center”).

The pre-tax money you convert will trigger some tax liability: it's treated as income tax. Why? Because it's the pre-tax money you never paid income tax for. It went directly from your employer to your 401K plan.

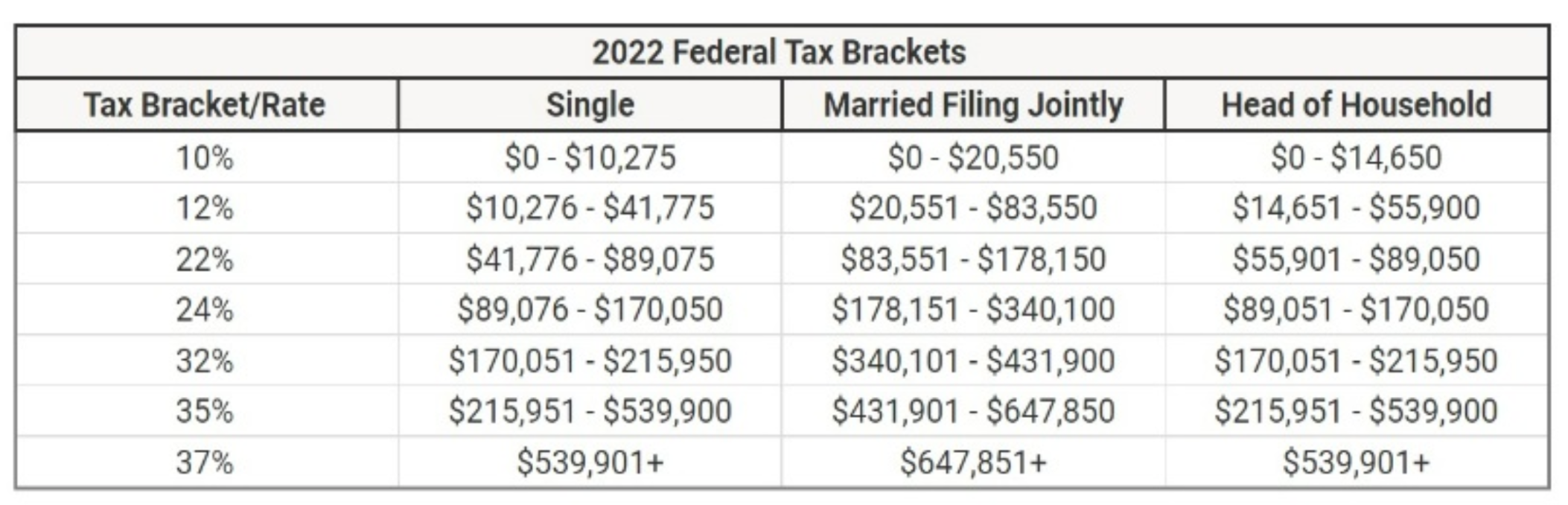

2022 Federal Tax Brackets

If you are converting a large sum of pre-tax, you will need to watch your tax bracket.

Let's suppose you are Married Filing Jointly, earning $250K a year. Before conversion, you are in the 24% tax bracket, with income up to $340,100 (let's simplify it to $340K). So now you have roughly $90K of “wiggle room” ($340K-$250K = $90K). You can choose to convert up to $90K pre-tax money to Roth, and you'll need to pay $90K x 24% tax.

Any conversion more than $90K will put you to the 32% tax bracket. You'll need to pay an additional 8% tax on top of 24%. So in this case – let's only convert $90K and save the rest for the next year.

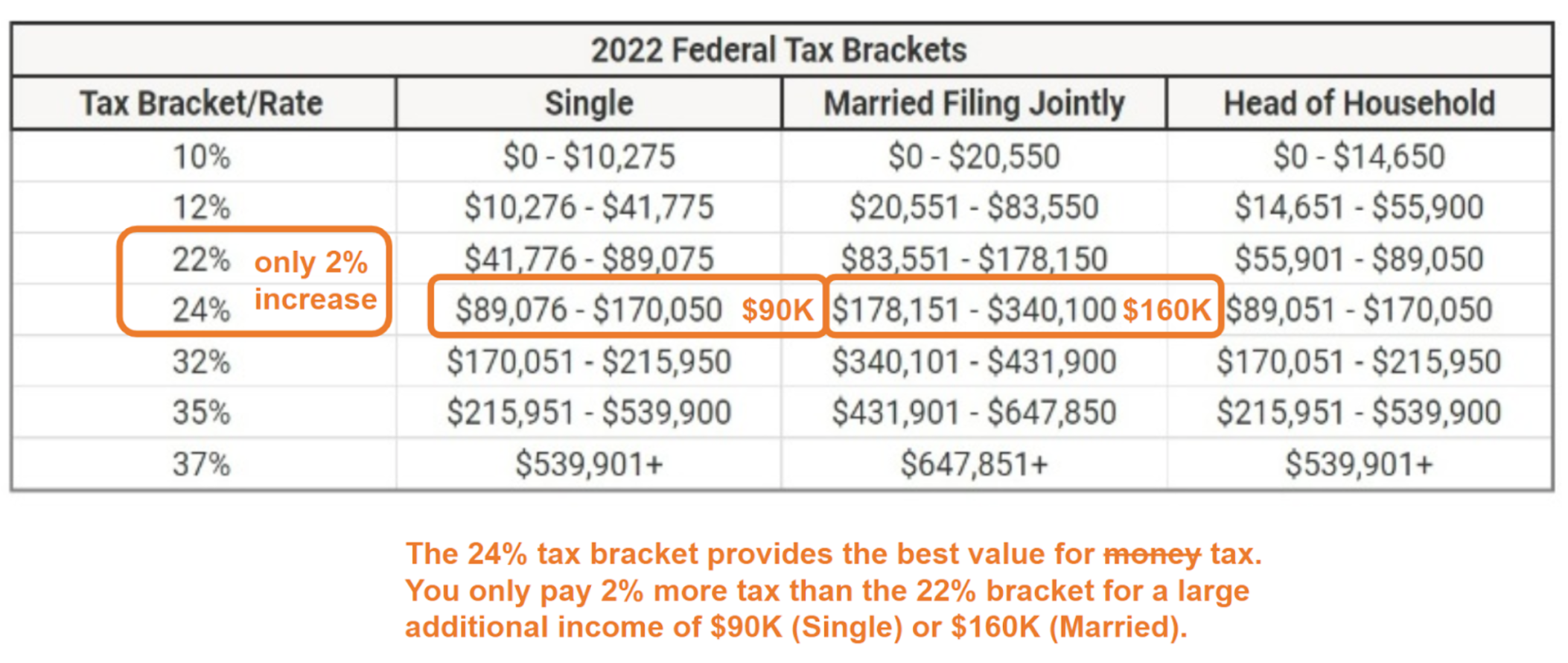

There are three simple rules of thumb when jumping between tax brackets:

Try to stay in your current tax bracket

If you cannot:

try not to jump from the 12% to 22% bracket

Or try not to jump from the 24% to 32% bracket

If you need to up your tax bracket, 22% to 24% provides the best value for tax because in the 24% bracket, for an entire $90K (Single) or $160K (Married), you only pay 2% more tax than the previous 22% bracket.

The 24% tax bracket provides the “best value for tax”.

In short: If you want to do it over multiple years, consider inflation, but before 2026!!

In the previous section we explained that we didn't want to trigger a huge tax bracket jump (i.e., 12% → 22% or 24% → 32%). Thus the amount we could convert is limited. We can plan it out over multiple years.

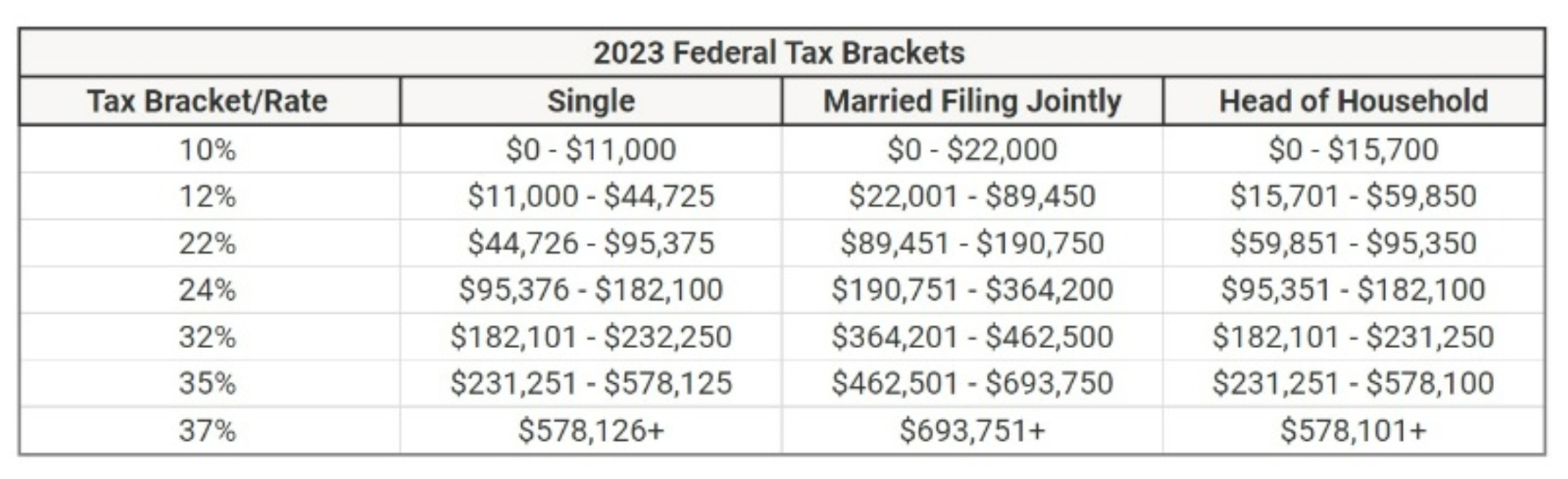

The “good” news is that due to inflation, there is about a 7% increase in the income limit for 2023. For instance, for the 24% bracket, it jumped from $89K-$170K (2022) to $95K to $182K (2023). So in 2023 you can convert 7% more.

But what about 2024 or 2025? Well, we need to consider the market. There's a fair chance that 2023 will be a not so good year for market growth. But in 2024 or 2025 there might be significant rebounds. We definitely do not want to incur even more taxes due to capital gain on the growth. Thus it's wise to convert to Roth when the market is down.

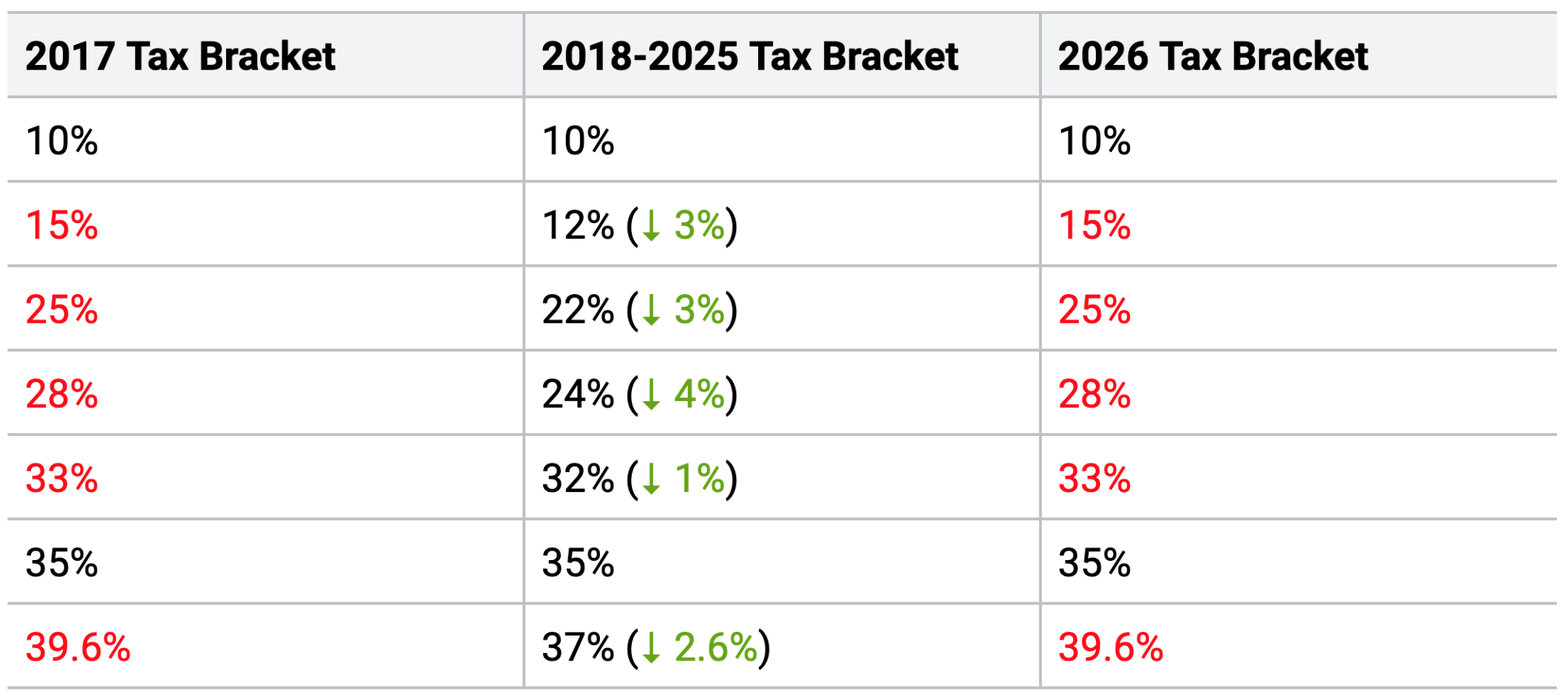

One thing we know for a high probability: 2026 is not a good year to do Roth conversion. Historically, we still live in a low tax era due to the Tax Cuts and Jobs Act (TCJA) which took effect in 2017. It will expire at the EOY 2025. Then households could see tax rates revert to 2017 levels on 1/1/2026:

Take advantage of the Tax Cuts and Jobs Act to do a Roth conversion through 2018-2025.

The current 22% tax bracket will become 25% in 2026. For most readers of this blog whose current tax brackets are in 12%/22%/24%, your tax rate will increase between 3% to 4% in 2026. That's why we want to stretch it out over the next few years, but before 2026.

Here are key takeaways of this blog:

Do your Roth conversion NOW, unless you plan to move to a lower tax state within a year

Vanguard provides an online interface to do it yourself

You'll need to call Fidelity to ask an advisor to convert to Roth for you

Be careful not to up your tax bracket too much when converting to Roth

The 24% tax bracket provides the best value for tax purposes

Stretch it over multiple years, but don't procrastinate

2026 will resume higher tax brackets, so finish your conversion before then.

Now you can do the following:

Pull out your last year's tax return (Form 1040) and find out your tax bracket and adjusted gross income (AGI). e.g., $100K at 24%, filing Single.

Compare and estimate your current year's gross income and tax bracket. e.g., still $100K at 24%, filing Single.

Reference to the Federal Tax Bracket table to find out how much room you have to convert your 401K to Roth. e.g., $70K given the upper limit of the 24% tax bracket is $170K.

Do a Roth conversion per instructions in this blog either online or by calling your 401K plan provider.

Still confused? Book a free session and let us help!