We will show you what Backdoor Roth IRA is and how to do it on Vanguard! Before you begin, make sure to Subscribe to Vobil's exclusive 📅 Personal Finance Calendar!

Legit: Explain what is the Backdoor and why it is legit.

Fund: Contribute to a traditional IRA

Build the Backdoor: convert to Roth IRA

Most important: Don’t forget to invest!

On tax day: how to get your taxes right

There are two ways to do the Backdoor Roth IRA:

The Backdoor Roth IRA lets you contribute (by converting) $6500 for 2023 and $6000 for 2022. If you are 50 or older, you can contribute $7500 in 2023. This is what the blog is about. It gives a step-by-step guide to do it on Vanguard, the correct sequence would be:

To simply put:

If you earn more than $228,000 for filing jointly or $153,000 for individuals, you cannot contribute to a Roth IRA. However, the 2017 Tax Cuts and Jobs Act made it clear that there’s no income limit when converting from an IRA to a Roth IRA (source). Thus the “backdoor” is created in two steps:

The caveat here is that you cannot contribute directly to a Roth IRA, but you can convert from one. That’s why in the beginning I said: The Backdoor Roth IRA lets you contribute (by converting) $6500 for 2023 and $6000 for 2022.

So it is legit, and it is as simple as two steps. Let’s get on to it.

When doing a Roth conversion, all money in your IRA account is subject to the pro-rata rule. Because from the IRS point of view, all your IRA accounts are treated as one and the money will be converted proportionately. Suppose you have two IRA accounts:

Then if you want to convert $6,500 to Roth, 90% of it will come from account 1, and 10% will come from account 2. And you need to pay the taxes on account 1.

If you already have another IRA account and still want to convert, please consult us.

We need an IRA account specifically for the conversion. If you haven't done so, it's easy. Vanguard is my brokerage platform of choice because my investment philosophy aligns with theirs, they are easy to use and very cost effective.

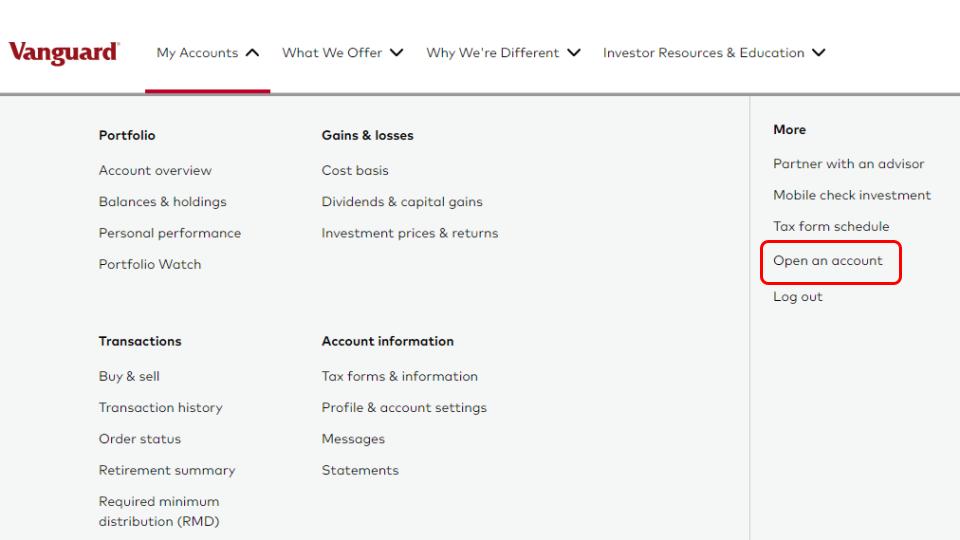

Log on to Vanguard, under “My Accounts”, on the most right hand side, there's a shortcut “Open an account”.

Open a Vanguard IRA account - Step 1

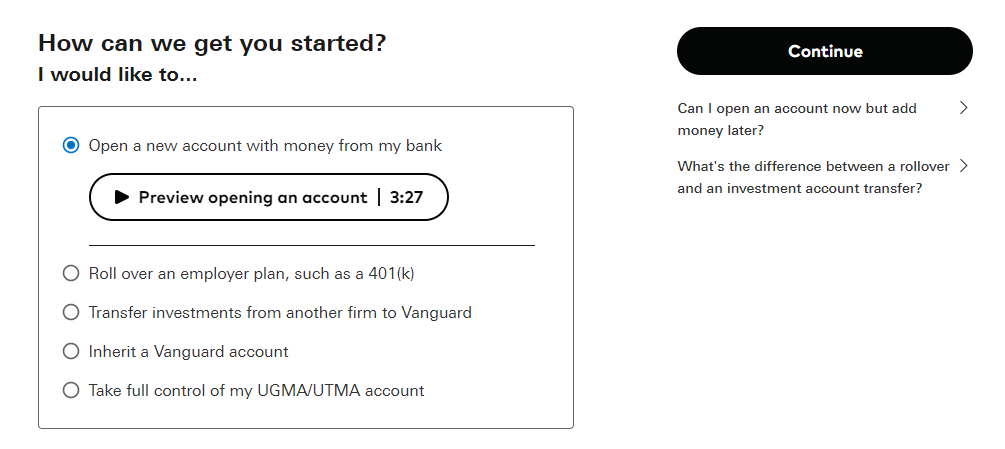

Follow the steps after that. You'll need a US address and social security number to be able to open an account.

Open a Vanguard IRA account - Step 2

If you are opening a traditional IRA account, there's a good chance that you don't have a Roth IRA account either. So why not go ahead and open it – you'll need two accounts to do the backdoor.

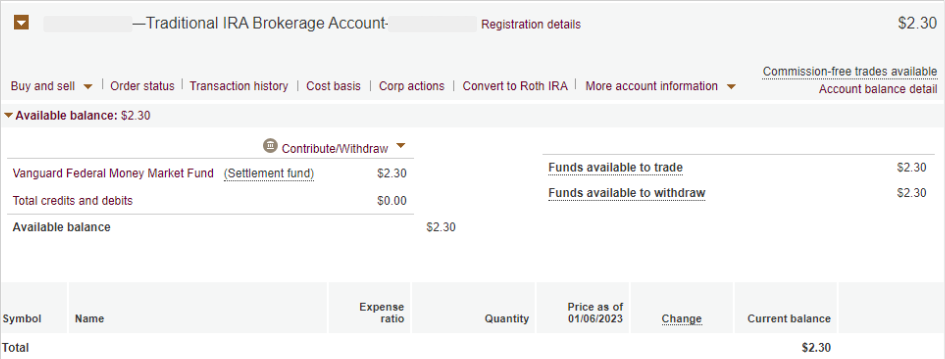

Once you have your account, it can be accessed from “Account Overview”. Then you'll see a “Traditional IRA Brokerage Account” there.

Traditional IRA account on Vanguard

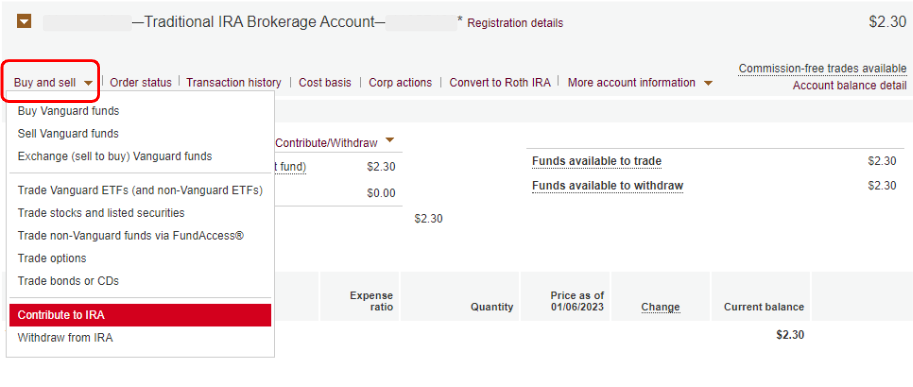

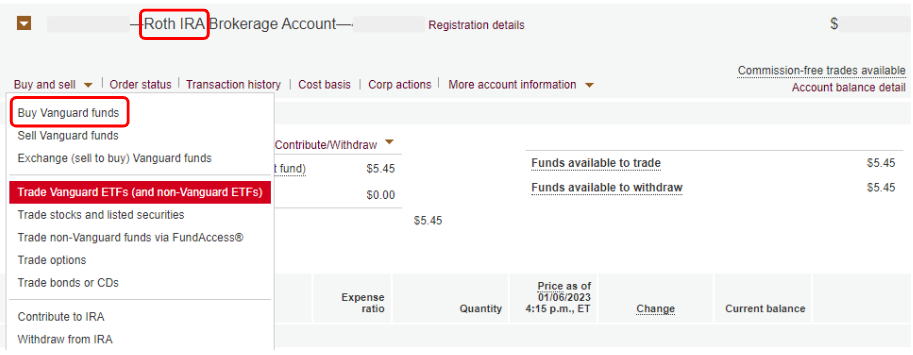

Click on “Buy and Sell”, there's an option “Contribute to IRA”.

Buy and Sell on Vanguard

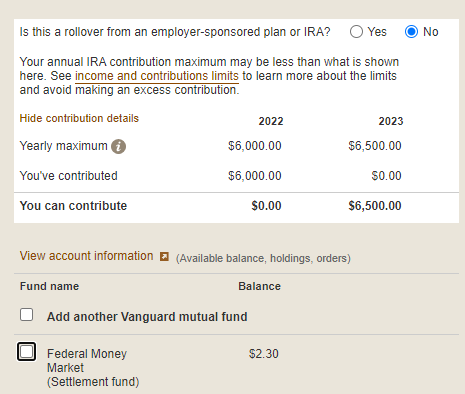

The next screen shows a lot of information:

Vanguard IRA Contribution

First it shows to me that in 2022 I already contributed my $6,000. So I cannot do it anymore. But for 2023, I have not contributed, so I can fund it.

What if you haven't contributed to last year's (2022) IRA? You can still do so until the tax day this year (roughly 4/15 every year).

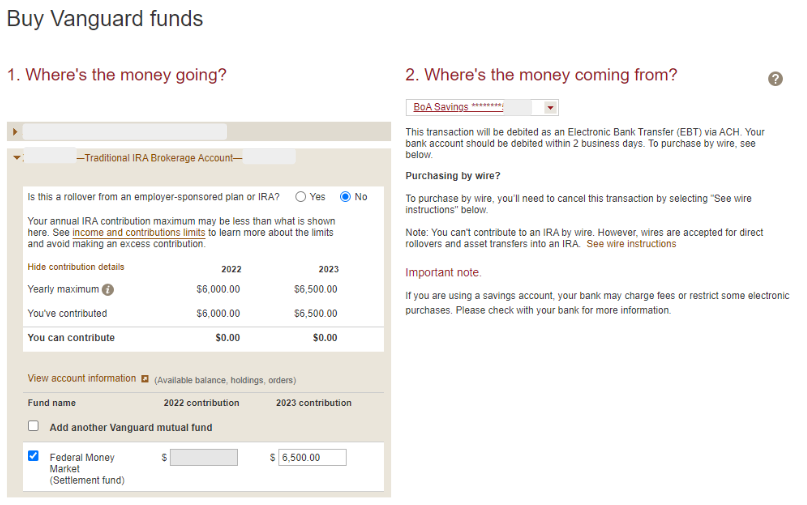

Then you can fund the IRA account by clicking “Federal Money Market”, specify the amount, and click “Continue”. Step 2 will ask where to get the money. I just use my bank account and Vanguard will pull the money from it.

Fund Vanguard IRA

Then Vanguard will do an ACH transfer from your account within 2 business days. So take a break and come back in two days.

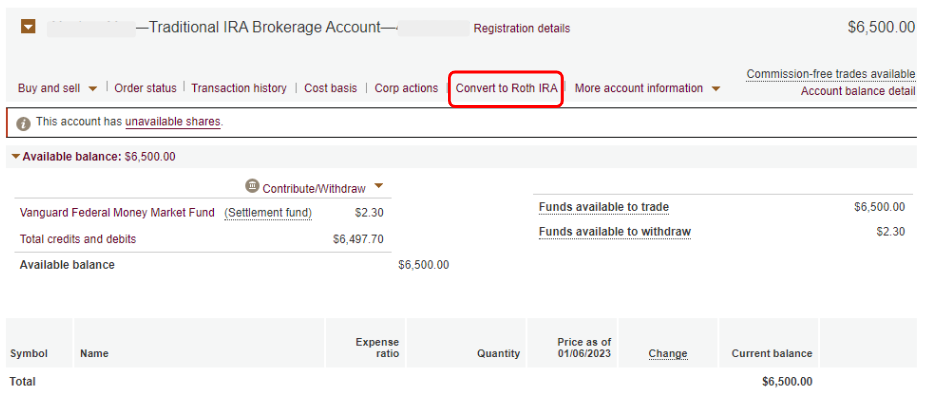

Once you have funded the Traditional IRA account, Vanguard makes it very easy to convert it to Roth: just click the “Convert to Roth IRA” button.

Convert to Roth IRA on Vanguard

Then Vanguard will walk you through 4 steps:

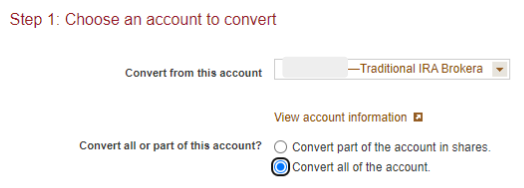

Convert to Roth IRA on Vanguard Step 1

You should be able to convert all money from the account to Roth since the account is only prepared for Roth.

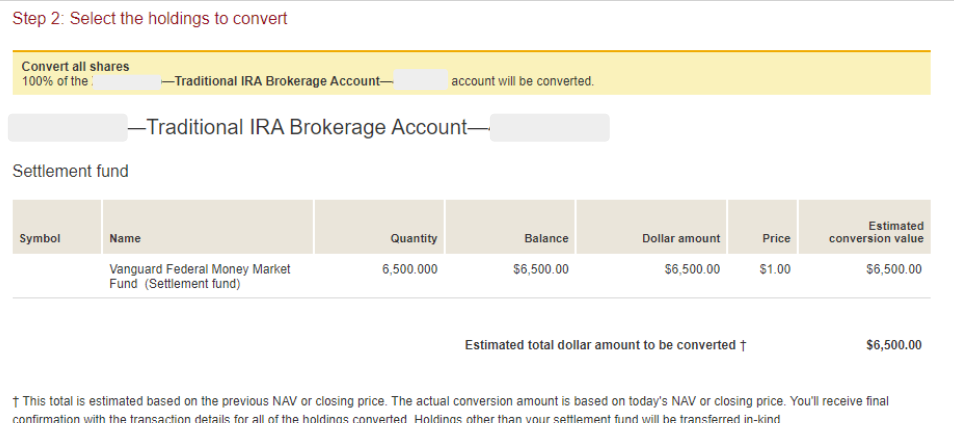

Convert to Roth IRA on Vanguard Step 2

Input $6500 for 2023's amount.

Convert to Roth IRA on Vanguard Step 3

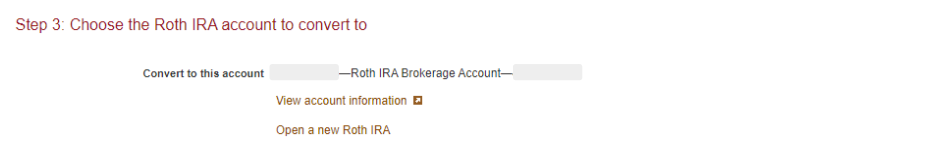

Select your Roth IRA account if you already have one. Otherwise open a new one.

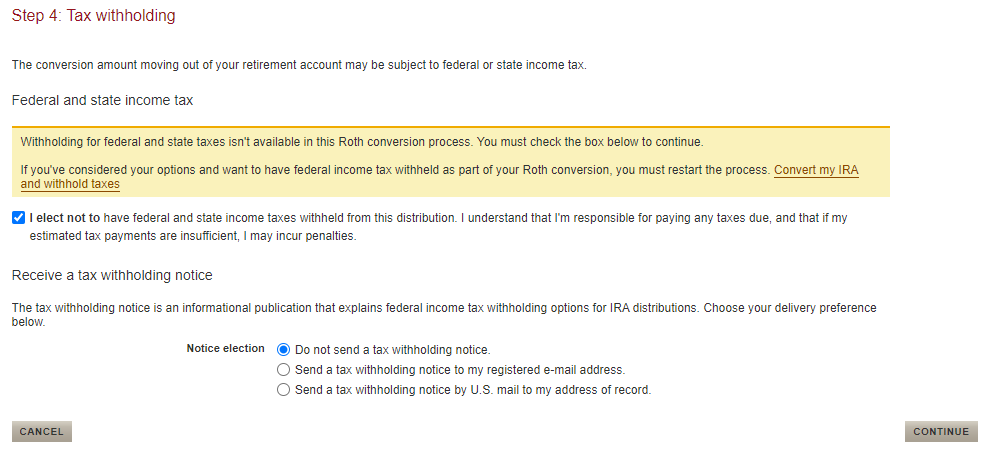

Convert to Roth IRA on Vanguard Step 4

You should click the first checkbox of not electing tax withholding, because you already paid taxes on the money. You should keep the first selected radio button of “Do not send a tax withholding notice” by default.

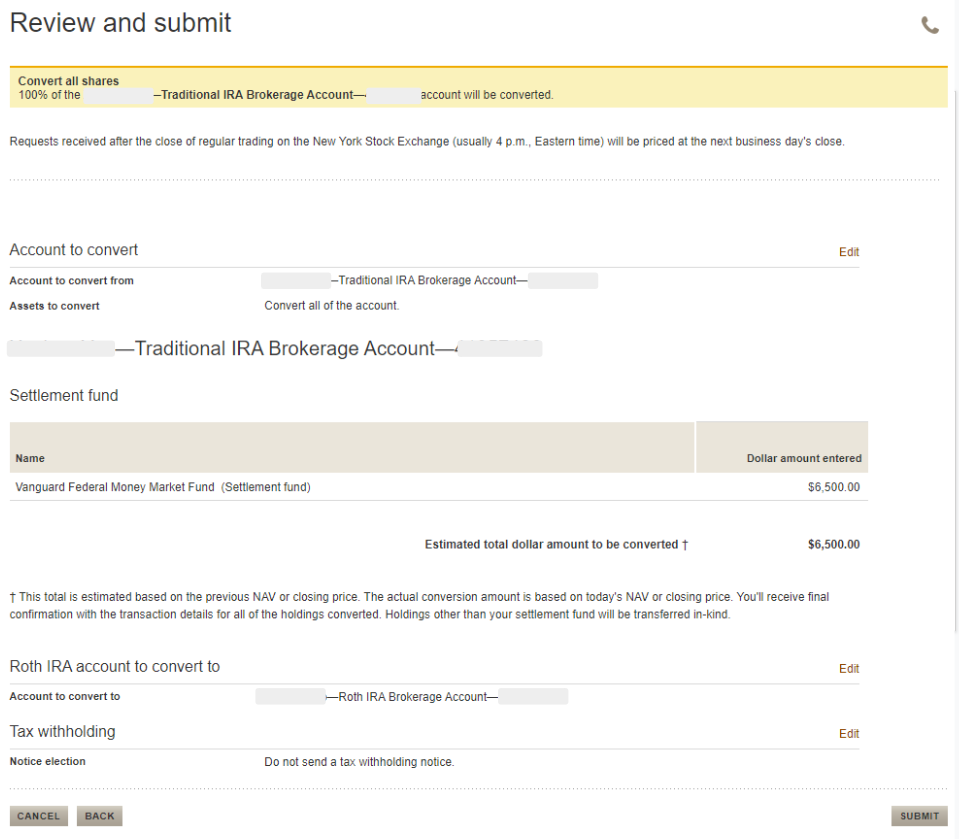

Click on “Continue”, review and submit, and you are one third done with your Roth conversion!

Convert to Roth IRA on Vanguard - Review and Submit

Why one third done? We still need to:

The Roth conversion is only a means to the ultimate goal of growing the Roth money tax-free. Thus after conversion, feel free to invest it! You can buy mutual funds, or trade ETFs. How to invest your money is another topic that I won't elaborate here. Personally I follow Brian Livingston's Papa Bear portfolios and invest my money three ways.

Invest Your Roth IRA on Vanguard

When it's tax day, you'll need to file the Form 8606 (instructions) to the IRS to report this conversion. I pay TurboTax to do all my taxes. Here's how to report the Roth IRA conversion in TurboTax.

There are a few ways to get a Roth IRA:

In summary, there are four steps to do the Roth IRA conversion:

I'd say the most important step is number 3: invest your Roth. So do it as early as possible. If you still have any questions, book a free consultation with us.